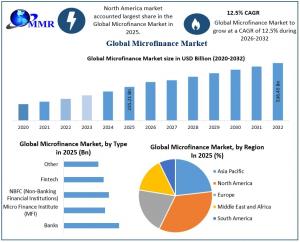

Microfinance Market Size, Share & Forecast 2025–2032: Rising Demand to Drive 12.5% CAGR, Reaching USD 536.45 Billion

Global Microfinance Market to Reach USD 536.45 Bn by 2032, Driven by Financial Inclusion, SME Lending, and Digital Microfinance Growth

Microfinance market breakthrough: digital credit and ESG funding drive expansion, says Maximize Market Research, new era of inclusive lending.”

NEW YORK, NY, UNITED STATES, January 27, 2026 /EINPresswire.com/ -- Microfinance Market size was valued at USD 235.21 billion in 2025 and is projected to witness robust growth at a CAGR of 12.5% during the forecast period 2025–2032, is expected to reach nearly USD 536.45 billion by 2032.— Maximize Market Research

Global Microfinance Market Size & Growth Outlook 2025–2032: Digital Credit, MSME Demand & ESG Funding

Global Microfinance Market Report 2025 provides an in-depth analysis of market trends, size, and forecasts through 2032. The industry is witnessing rapid growth driven by rising demand for digital credit scoring, MSME financing, and inclusive lending solutions. Increasing adoption of fintech platforms, embedded finance, and AI-driven risk assessment is transforming the market landscape. Growth in women-led entrepreneurship, financial inclusion initiatives, and policy-backed credit guarantees continues to shape the future of the global Microfinance Market. Digital transformation, ESG-linked investment, and regional expansion across Asia-Pacific are key factors fueling market growth worldwide.

Get a Free PDF Sample> https://www.maximizemarketresearch.com/request-sample/230628/

Microfinance Market Growth Catalysts: Digital Credit, MSMEs & ESG Capital

Digital credit scoring and AI lending are expanding access to underserved borrowers, reshaping global microfinance demand.

Rising MSME financing and women-led entrepreneurship are fueling strong loan growth and market momentum.

ESG funding, embedded finance, and fintech partnerships are driving sustainable expansion and scalable microfinance ecosystems.

What’s Driving Global Microfinance Market Growth? Digital Credit, MSME Demand & Policy Support

Global microfinance market growth is being rapidly reshaped by digital credit scoring technologies, rising MSME financing demand, and government-backed risk mitigation frameworks. As microfinance institutions (MFIs) expand access to first-time borrowers and women-led enterprises, the global microfinance market size and loan demand continue to accelerate, reinforcing a strong double-digit growth outlook through 2032.

Why Global Microfinance Growth Is Cooling: Asset–Liability Stress and Saturated Markets

Global microfinance market faces critical growth constraints as asset–liability mismatches, regional borrower over-indebtedness, and regulatory limits on interest rates strain lender profitability. In addition, climate-linked income volatility among rural borrowers heightens credit risk, compelling microfinance institutions to tighten underwriting norms and moderate expansion across saturated and high-risk geographies.

Why the Global Microfinance Market Is Poised for Expansion: Platform Lending & ESG Capital

Global microfinance market is unlocking high-value opportunities through embedded finance models, AI-enabled portfolio monitoring, and platform-based microfinance distribution. As microfinance institutions (MFIs) evolve into full-service financial ecosystems and attract rising ESG and impact investment, scalable digital models are expanding market reach, strengthening portfolio quality, and reshaping global microfinance demand beyond traditional branch-led lending.

Global Microfinance Market Segmentation Revealed: MFIs, Digital Lenders & Rural Borrowers Driving Growth

Global microfinance market segmentation reveals a dynamic shift, with Micro Finance Institutions (MFIs) dominating the microfinance lending landscape due to deep rural penetration and strong group-lending discipline. Fintech-driven microfinance platforms are rapidly expanding digital loan distribution, while banks and NBFCs focus on urban borrowers. By loan type, income-generating and emergency loans lead, and MSMEs, women entrepreneurs, and rural communities are emerging as the most active microfinance market end users, driving next-level market expansion.

Details insights on this market, request for methodology here> https://www.maximizemarketresearch.com/request-sample/230628/

By Type

Banks

Micro Finance Institute (MFI)

NBFC (Non-Banking Financial Institutions)

Fintech

Other

By Loan Type

Income-Generating Loans

Consumption Loans

Emergency Loans

Agricultural Loans

Others

By End User

Individual Borrowers

Micro, Small, and Medium Enterprises (MSMEs)

Women Entrepreneurs

Farmers and Rural Communities

By Region

North America (United States, Canada and Mexico)

Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN (Indonesia, Malaysia, Myanmar, Philippines, Singapore, Thailand, Viet Nam etc.) and Rest of APAC)

Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A)

South America (Brazil, Argentina, Colombia and Rest of South America)

Top Trends Shaping the Global Microfinance Market: Digital Credit, ESG Funding & AI-Driven Lending

Shift from Group to Individual Lending Fuels Digital Credit Revolution: Global microfinance market is rapidly shifting from traditional group lending to individual lending models, powered by digital credit scoring and tech-enabled risk assessments. This trend is opening new credit channels for underserved borrowers and reshaping microfinance loan demand.

ESG-Linked Capital Is Transforming Microfinance Funding: Investor interest in ESG and impact investing is creating a major funding wave in the microfinance market. Capital is increasingly flowing into climate-resilient finance, women-owned MSMEs, and gig-worker protection, boosting sustainable lending and strengthening market credibility.

AI and Data Analytics Drive Smarter Microfinance Lending: Microfinance institutions (MFIs) are adopting AI, machine learning, and data analytics to automate credit checks, detect fraud, and personalize loan products using alternative data sources. This digital transformation is accelerating global microfinance market growth and improving portfolio quality.

Latest Microfinance Market Developments 2025–2026: Strategic Shifts, Major Partnerships & Impact Milestones

On July 18, 2025, Bandhan Bank reported significant shifts in its microfinance strategy as it provisioned ₹1,147 crore for stressed EEB loans and accelerated its pivot to secured micro- and SME-focused credit to strengthen asset quality.

On January 25, 2026, BRAC Microfinance (BRAC) partnered with foodpanda to offer collateral-free microcredit, savings, and insurance products to delivery riders, expanding inclusive financial services nationwide.

On November 11, 2025, BRAC Microfinance (BRAC) earned the prestigious CPC Gold certification for client protection excellence, underscoring its commitment to responsible microfinance and market leadership.

On August 25, 2025, Kiva marked its 20th anniversary of catalysing over $2.3 billion in loans to underserved communities globally, spotlighting its enduring impact in expanding financial inclusion.

On January 31, 2025, Bank Rakyat Indonesia (BRI) launched the BRI UMKM EXPO 2025 and Microfinance Outlook to empower MSMEs and elevate inclusive microfinance engagement.

Regional Pulse: How Asia-Pacific, North America & Emerging Markets Are Redefining the Global Microfinance Market

Asia-Pacific dominates the global microfinance market, fueled by vast rural populations, rising MSME financing needs, and strong financial inclusion initiatives. India and Bangladesh lead microfinance market penetration, while digital lending and SHG-based models expand access. As microfinance institutions (MFIs) and fintech platforms scale, the region continues to set the pace for microfinance market size, loan demand, and innovation.

North America and Europe are shaping the global microfinance market through impact investment and fintech innovation, with strong ESG capital flows and institutional funding supporting global microfinance outreach. Meanwhile, Africa and Latin America show rising demand for digital microloans, especially among women entrepreneurs and rural communities, signaling a major shift toward technology-driven financial inclusion and scalable microfinance market ecosystems.

Global Microfinance Market Competitive Landscape: Key Players, Digital Innovation & ESG Funding Battles

Global Microfinance Market Competitive Landscape is marked by intense innovation and strategic differentiation. Bandhan Bank’s secured micro-credit pivot, Kiva’s digital crowdfunding scale, and BRAC’s client-protection leadership set high benchmarks. Legacy pioneers like Grameen Bank drive community impact, while agile players such as Svatantra Microfinance, BSS Microfinance, and Al Amana harness fintech to expand financial inclusion. Global leaders FINCA and Grameen Foundation are shaping the market through ESG-backed microfinance funding and scalable digital lending models.

Browse Complete Research Report>https://www.maximizemarketresearch.com/market-report/microfinance-market/230628/

Microfinance Market, Key Players:

Bandhan Bank

Kiva

BRAC

Bank Rakyat Indonesia

BSS Microfinance Private limited

FINCA International

Grameen Bank

Svatantra microfinance

Al Amana Microfinance

Grameen Foundation

Accion International

Opportunity International

Bharat Financial Inclusion Limited

Cashpor Micro Credit

Compartamos Banco

IndusInd Bank Limited

Manappuram Finance Ltd

Spandana

Women's World Banking

Sparkle Microfinance Bank

CARD MRI

Amret Co Ltd

Accion International

Kingdom Bank Ltd

Aregak UCO

Acleda Bank Plc

MIBANCO Banco de la Microempresa SA

Banco Caja Social

ProCredit Holding AG & Co.

BRAC Bank Ltd

Key Highlights:

Rising MSME Financing Needs: Increasing micro-entrepreneurship in emerging economies has pushed demand for short-tenure working capital microloans.

Women-led Financial Inclusion: Growth in women-focused group lending and JLG models improved repayment discipline and strengthened portfolio quality across key regions.

Policy Support & Risk Mitigation: Government-backed credit guarantees and interest subvention programs have reduced credit risk and enabled MFIs to scale lending volumes.

AI & Embedded Finance Innovation: AI-driven portfolio monitoring, fraud detection, and platform-based microfinance distribution are improving efficiency and expanding market reach.

ESG & Impact Investment Growth: Rising ESG capital inflows are funding MFIs with strong governance, enabling sustainable expansion and stronger balance sheets.

FAQs:

What is the current size of the Global Microfinance Market and what is its forecast?

Ans: Global Microfinance Market size was valued at USD 235.21 billion in 2025 and is projected to reach USD 536.45 billion by 2032, driven by digital credit adoption and rising MSME demand.

What are the major growth drivers reshaping the Global Microfinance Market?

Ans: Global Microfinance Market growth is being fueled by digital credit scoring, rising MSME financing demand, and government-backed risk mitigation frameworks, which are expanding access for first-time borrowers and women-led enterprises.

What key restraints are impacting the Global Microfinance Market?

Ans: Growth is constrained by asset–liability mismatch, borrower over-indebtedness, regulatory interest rate caps, and climate-linked income volatility, causing lenders to tighten underwriting and slow expansion in saturated regions.

Which regions dominate the Global Microfinance Market and why?

Ans: Asia-Pacific leads the global microfinance market, driven by large rural populations, strong financial inclusion initiatives, and digital lending models. North America and Europe influence the market through impact investment and fintech innovation.

What are the latest trends shaping the Global Microfinance Market?

Ans: Key trends include digital credit revolution, ESG-linked capital inflows, and AI-driven portfolio monitoring, enabling scalable microfinance ecosystems and transforming how MFIs deliver loans and services.

Analyst Perspective:

Market observers note that the global microfinance sector is undergoing a strategic transformation, driven by digital credit scoring and embedded finance that broaden access to underserved borrowers while strengthening portfolio quality. ESG-linked capital and impact-driven funding are increasingly influencing investor decisions, highlighting attractive returns for institutions with strong governance and responsible lending practices. Competitive intensity is rising as fintech disruptors and legacy MFIs vie for market share, with partnerships and innovation serving as key growth accelerators.

Related Reports:

Finance Cloud Market: https://www.maximizemarketresearch.com/market-report/global-finance-cloud-market/63314/

AI-Powered Personal Finance Management Market: https://www.maximizemarketresearch.com/market-report/ai-powered-personal-finance-management-market/222191/

Cryptocurrency Market: https://www.maximizemarketresearch.com/market-report/cryptocurrency-market/221768/

Premium Finance Market: https://www.maximizemarketresearch.com/market-report/premium-finance-market/213507/

Top Report:

K-pop Events Market size was valued at USD 14.27 Billion in 2025 and the total K-pop Events revenue is expected to grow at a CAGR of 7.5% from 2025 to 2032, reaching nearly USD 23.68 Billion by 2032: https://www.maximizemarketresearch.com/market-report/k-pop-events-market/186929/

Cider Market size was valued at USD 17.42 Billion in 2025 and the total Cider revenue is expected to grow at a CAGR of 6.4% from 2025 to 2032, reaching nearly USD 26.90 Billion by 2032:https://www.maximizemarketresearch.com/market-report/global-cider-market/27300/

Business Process Outsourcing Market size was valued at USD 326.11 Billion in 2025 and the total Business Process Outsourcing revenue is expected to grow at a CAGR of 9.23% from 2025 to 2032, reaching nearly USD 605.01 Billion by 2032:https://www.maximizemarketresearch.com/market-report/global-business-process-outsourcing-market/66545/

Online Event Ticketing Market size was valued at USD 64.52 Billion in 2025 and the total Online Event Ticketing revenue is expected to grow at a CAGR of 4.8% from 2025 to 2032, reaching nearly USD 89.58 Billion by 2032:https://www.maximizemarketresearch.com/market-report/global-online-event-ticketing-market/23536/

Hypervisor Market size is estimated to grow at a CAGR of 29.78%. The market is expected to reach a value of US $ 9.70 Bn. in 2030:https://www.maximizemarketresearch.com/market-report/global-hypervisor-market/79909/

Lumawant Godage

MAXIMIZE MARKET RESEARCH PVT. LTD.

+91 96073 65656

email us here

Visit us on social media:

LinkedIn

Instagram

Facebook

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.